We help nonprofits, individuals and families, foundations and corporations meet their philanthropic goals and make a bigger impact.

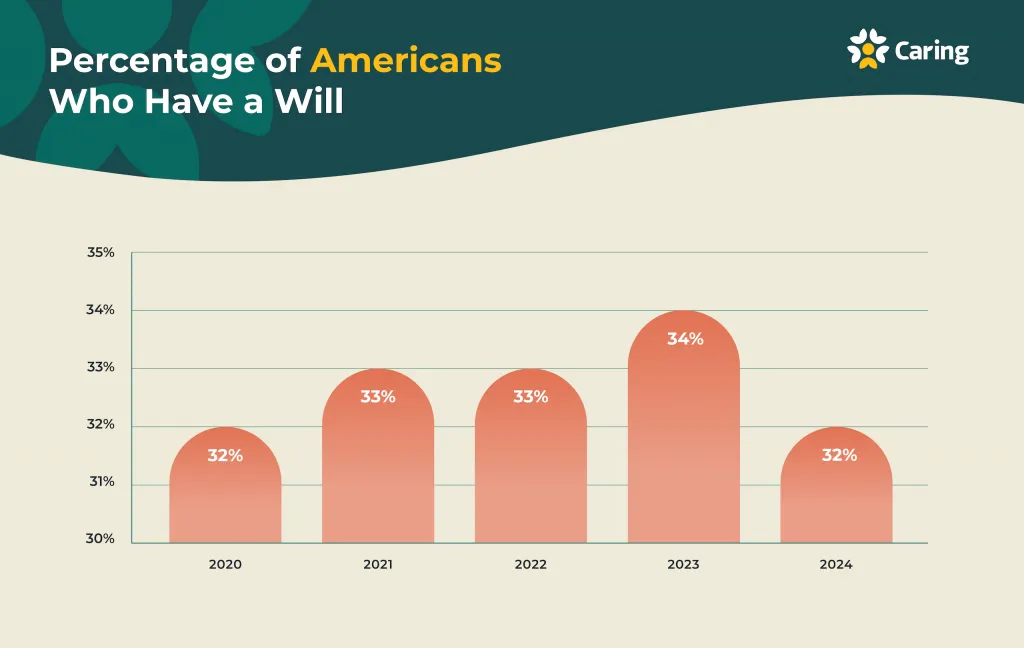

70% Of Individuals Do Not Have A Will Or Trust

Only 30% of Americans have a will or trust in place - The rest of the population have left their assets in the hands of state appointment lawyers and judges to decide for them.

Take control by creating a robust estate & tax plan

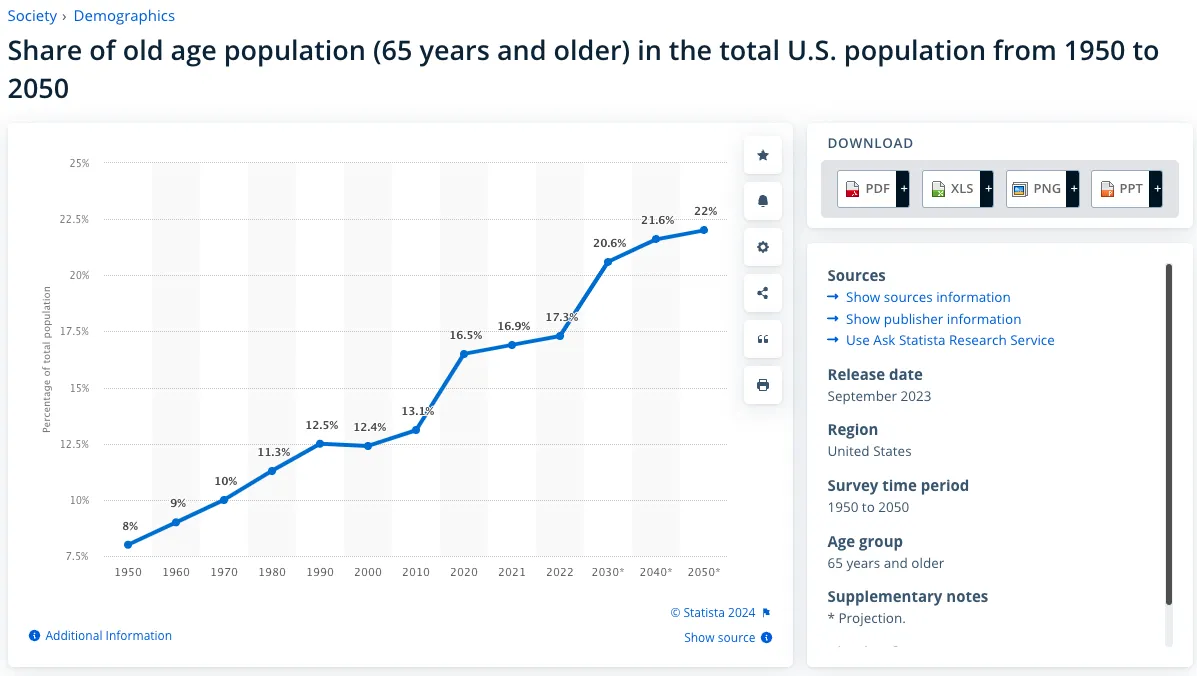

4 Million People Are Turning 65 Every Year

Over 10,000 individuals turn 65 every day in the United States, totaling more than 4 million annually. Most of them have no estate plans in place, leaving their legacy and wealth exposed.

Don't leave your loved ones exposed to stressful court processes

Taxes Rates Are Increasing In 2026

The Tax Cuts & Jobs Act is scheduled to sunset in 2025, leading to increases in several layers of taxes, including federal income taxes, and federal estate and gift taxes (which go up to 40%).

Take action by learning and preparing ahead of time

Our Unique Approach Solves Multiple Bottom-Lines -

We go beyond the law and partner with our clients, helping them them establish a Mini Family Office: a concept where legal, tax, and financial decisions are made in a highly coordinated, aligned, and methodical manner. Here are the different components that we help our clients solve and accomplish

Asset & Estate Protection

We offer comprehensive estate and tax planning services for individuals and families looking to leverage wills, trusts, and foundations to preserve their legacy.

We offer end-to-end evaluation, consulting, filing, drafting, and ongoing support as well.

Tax-Savvy Investing & Exits

We help investors looking into buying and selling assets in a tax-friendly setting by helping them leverage several legal and tax strategies.

We evaluate multiple scenarios and figure out the most optional way to control and sell assets.

Start An Online Business (Tax Consulting)

We parter and train with professionals involved in the world of law, tax, and finance with strategies that could be incorporated into their existing business.

Estate and tax planning impacts every single person that you know - why not monetize that opportunity!

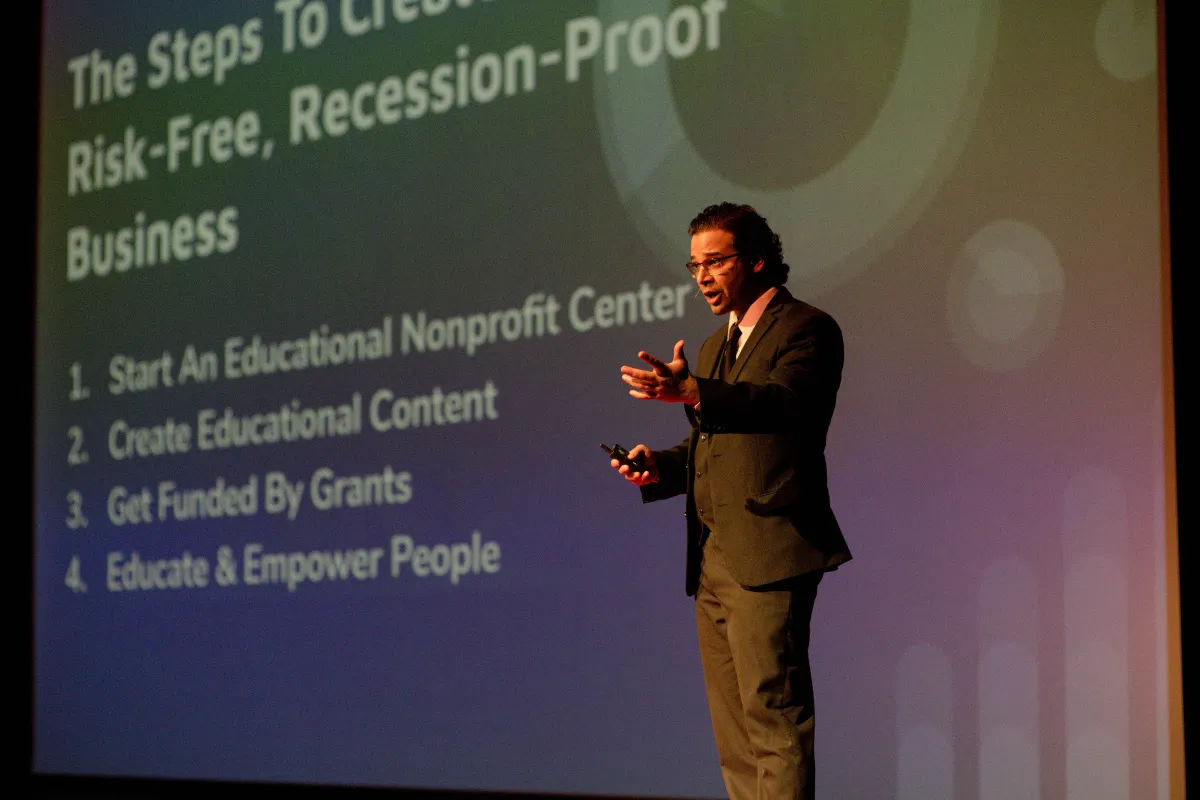

Public Nonprofit Services

We offer end-to-end business, legal, strategy, marketing, grant acquisition, growth, and consulting services for public nonprofit organizations.

We have built several hundred educational and research based nonprofits that are funded with grants.

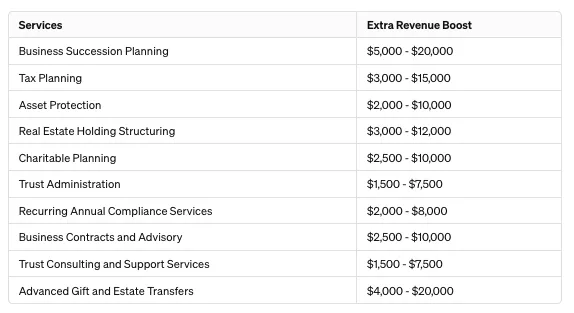

Here are several compelling reasons to bolt-on Law Firm In A Box to your law firm

Virtual, lucrative, meaningful, and flexible!

Estate and tax law is a highly flexible and personalized practice area.

It offers several different sub-niches, like probate, trusts, foundations, business succession, and even Mini Family Office™ type services

You can specialize in drafting, filings, consulting, or strategic planning.

Generally, there are no hourly billing and offers flexible fee structures like flat fees, subscriptions, or even contingent fees.

Estate and tax law are highly flexible practice areas that can be 100% online and virtual as well.

Serve your clients, or your competitors will!

Every client will purchase estate and tax planning from another firm—why not monetize this opportunity?

There are multiple layers of estate and tax services that can generate $5K-$50K+ per case.

Ignoring these needs is like handing $5K-$50K per case to your competitors.

Stop losing clients to other firms and start leveraging Law Firm In A Box.

Tap into revenue streams from clients who already know, trust, and have paid you.

Massive demand, limited supply!

Over 10,000 people turn 65 every day, totaling about 4 million annually.

This trend will rise for the next 2-3 decades.

Likely, 2/3 of these individuals lack an estate and tax plan—a gap we can fill together.

The largest wealth transfer in history is happening now: we can tap into this opportunity in a profitable and highly impactful way.

We partner with lawyers and accountants ready to help families protect their assets and wealth.

More lawyers, less scammers needed!

Only 30% of Americans have a will, and even fewer use trusts.

Two out of three people you meet daily could benefit from our integrated services.

The gap in estate and tax planning has attracted many unqualified individuals who have no business offering trust or tax services.

Since COVID, many entrepreneurs and investors have been misled by dubious trusts and tax schemes, including many of my clients.

The IRS’s "Dirty Dozen" list highlights top tax scams, often promoted by non-lawyers.

My mission is to partner with attorneys nationwide to combat fraud and provide proper legal and tax help.

Estate and tax planning is an excellent niche for attorneys looking to expand their practice while having a direct impact in people's lives.

Lawyers needs robust estate planning too.

Many lawyers and professionals are not fully leveraging estate and tax laws in their businesses, investments, and personal lives.

Most law firm owners or partners likely haven't structured their entities and tax plans for a smooth exit or transition.

Entering this field is financially rewarding and offers a risk-free business expansion strategy when partnering with us.

The return on investment from learning and applying these strategies within your firm—and in your personal life—is limitless as well.

Estate and tax strategies we develop together can protect your legacy and life's work, while helping your clients achieve the same goals.

Our team is dedicated to this work because we believe in its power to protect and preserve what matters most.

ThousandsWe have restructured thousands of estates and portfolios over the past two decades

Millions We are on a quest to help millions of families protect their wealth and loved ones

BillionsWe have protected billions in assets and reduce billions in unnecessary debt & taxes.

Our team

We are a diverse team of entrepreneurs, investors, attorneys, accountants, ex-IRS auditors, real estate professionals, and financial advisors on a mission to help more Americans protect their assets, preserve their assets, and reduce taxes while are alive and after their death.

Sid Peddinti is a TEDx Speaker, Investor, and Attorney who has been involved in the world of law, tax, and finance for the past two decades in diverse capacities. He specializes in helping entrepreneurs and investors create "mini family offices" and become much more strategic, aligned, and coordinated in their legal and tax strategies.

Sid Peddinti is a TEDx Speaker, Investor, and Attorney who has been involved in the world of law, tax, and finance for the past two decades in diverse capacities. He specializes in helping entrepreneurs and investors create "mini family offices" and become much more strategic, aligned, and coordinated in their legal and tax strategies.

Two Sample Case Studies

Here's a "behind-the-scenes" look at some of the strategies that we are in the midst of formulating and implementing for our clients...

Profile: Business Owners And Investors

We are working with the owners of a consulting firm who plan to exit their business within the next two years and reinvest their profits across various asset categories. They prefer to avoid a 1031 exchange in order to diversify their portfolio and have more control over the cash and assets.

Our focus is on aligning their corporations, wills, revocable trusts, irrevocable trusts, and foundations from a legal standpoint, while also coordinating various tax strategies to address both current and future tax obligations.

We are helping create a Mini Family Office™, and help their business advisors, finance teams, investment brokers, insurance agents, corporate lawyers, and accountants align in their overall strategy. The goal is to get everyone operating from ONE playbook and align in their strategy.

Here are a list of tax strategies that we look at lowering or avoiding by using different entities:

Income taxes on the high individual AGI

Capital gains taxes on the business sale

Federal trust and estate taxation

Capital gains on stocks & bonds

Probate and legal costs

State inheritance and estate taxes

New step-up basis for trusts

The impact of TCJA sunsetting

One of their main goals in life is to create a legacy that's deeply rooted in social and humanitarian contribution - their vision is to incorporate private foundations and make philanthropy a core pillar of their family's operating motto, as encouraged by the tax code: Boost Your Net Worth By Giving Back.

Profile: High-W2 Wage Earners And Investors

We are working with a power couple in their 40s, a lawyer and an engineer, with high AGI, paying six-figures in income taxes annually. They have two children, ages 10 and 14, and several categories of assets and investments.

Their goals include:

- Reducing their annual tax burden

- Increasing their charitable contributions

- Enhancing their insurance coverage

- Creating trust funds for their children

- Diversifying their investment portfolio

They were referred to us by a joint venture partner, a seasoned Financial and Insurance Advisor at a large investment firm who has been working with the couple for a few years.

We are helping them establish a combination of entities, including a limited liability company (LLC), a revocable trust, a pour-over will, an irrevocable life insurance trust (ILIT), an irrevocable trust, and a private foundation.

Each entity serves a distinct purpose, but together they create a cohesive strategy. Once again, we're helping the couple set up a "mini family office" so they can make financial and estate decisions much like they would in a corporate setting.

The concept behind the family office is that personal and family legal, tax, and financial decisions are evaluated and made like they would in a corporation or investment brokerage.

By restructuring their existing assets (stocks, funds, crypto, and real estate) into LLCs, trusts, and foundations, we aim to reduce their current tax burden by 30% annually, while formulating alternative methods to lower "future taxes and costs" as well.

This approach also provides greater control over their investments, minimizes personal risk, and allows them to utilize gifting laws to establish robust insurance policies for their children.

Get A Free Consultation To Discover How You Can Protect Assets, Lower Risks, And Reduce Taxes With A Robust Estate & Tax Plan In Place

100% Confidential and Private Information

Upcoming Events

Our affiliate courses are designed by experts who have years of experience and proven results in the affiliate marketing industry.

6. Fueling Change: Lifetime Funding and Tax-Free Investing for Nonprofits

learn how to recycle your tax dollars towards more impactful investments ...more

Private foundations

January 14, 2025•2 min read

4: Charitable Tax Deductions: Unlocking Benefits for Individuals, Corporations, and Foundations

how to leverage nonprofits and foundations to extend and maximize the value, impact, and utility your dollar ...more

Private foundations

January 14, 2025•2 min read

Enhance your Estate & Tax Planning knowledge

Take advantage of our resources! Get familiar with estate and tax planning concepts, you are going to use in for the rest of your life, and it also impacts your wealth after your death!

The Tax Code Loves Philanthropists

Discover why private foundations are popular among the ultra-wealthy and how entrepreneurs and investors can benefit from starting one. ...more

Private foundations

June 26, 2024•8 min read

20 Benefits of Starting a Foundation

Explore 20 unique ways to protect assets, preserve wealth, and lower taxes by starting a family foundation. Join our free workshop to learn more from experts. ...more

Private foundations

June 26, 2024•2 min read

How to Start a Non-Profit Organization

Learn how to start and grow a nonprofit organization with our 10-step process. ...more

Private foundations

June 26, 2024•2 min read

Double Bottom Line

Discover how business owners can thrive by creating a nonprofit organization, aligning profits with purpose through strategic philanthropy, and leveraging tax benefits. ...more

Private foundations

June 26, 2024•5 min read

The ART of Estate Planning

Discover how entrepreneurs and investors can protect assets, reduce taxes, and preserve wealth using wills, trusts, and foundations with expert estate planning. ...more

Wills and Trusts ,Private foundations Advanced Tax Strategies &Asset Protection

June 26, 2024•5 min read

The Entrepreneur's Law and Tax Playbook: How To Leverage Different Legal Entities For Asset Protection And Tax Reduction

Master asset protection and tax reduction with expert strategies on legal entities. Learn to leverage LLCs, trusts, and private foundations for financial security. ...more

Private foundations ,Asset Protection

June 26, 2024•4 min read